What were we solving for?

Xfinity Cable subscribers and Comcast partners (XClass TV, Cox Cable, Xumo TV, Xumo Stream Box, Xfinity Flex TV Box and X1 TV Box) would be presented with an informational campaign to let existing perpetual Bundle subscribers know that in order to keep Peacock Premium, they will have to pay, and that there will be a limited-time offer to ease the transition.

This project is known as “MVPD Roll to Pay”. MVPDs are service providers that deliver multiple television channels to customers.

Comcast planned to implement Peacock Billing Integration with our partners, as well as our products.

Objectives:

User goals: To understand the change in their plan, to continue watching streaming entertainment at a reasonable cost.

Business goals: Comcast had 16m bundled subs (7m are MAAs), with the target of 1.1m rolling forward into paid subscriptions. This effort would be one of the largest focal points for the organization.

Timeline: Development efforts would take over 15 months across teams within product & technology and across the Comcast family of companies (Comcast/NBC/SKY).

Success metrics: Convert 1.5m existing users into paid Peacock TV customers, in partnership with the deemphasis of the Free Tier for Peacock.

My role:

Acting Principal Designer, collaborating with one Sr. Product Designer, Principal Product Manager, PMO, Sr. Design Manager, Sr. Strategist, Engineers across all platforms, Machine (a boutique agency), Marketing, Customer Insights and UX Copy Manager. Presented key work to stakeholders during the project lifecycle. The team won internal award, "Top of the Flock", Q3 2023.

Customer insights

Conducted customer interviews to drive product development

Findings:

Initial exploratory insights to:

Understand attitudes around subscribers' current Free and Bundled experience, and to inform a future round of Quant research to validate key findings.

Meet the user where they're at

Some customers forgot they had Peacock for free. If we gave them ample time with messaging/notifications, they would subscribe because they would understand what was happening.

Hand-hold customers to continue with Peacock

Users need to be shown what they're missing if they don't pay/upgrade, especially content they can't get elsewhere.

Bring value together

Paid Premium is priced well, and can overcome resistance.

Customer archetypes

Nicole, 52

Office Manager, married, lives in suburbs

Nicole, 52

Office Manager, married, lives in suburbs

Considers herself a discount hunter.Actively seeks offers and deals, even if she needs to go out of her way to find and activate them.

Feels a thrill when she finds a deal, and brags about it with friends.

She and her husband have kept their cable subscription, they watch linear TV sports.

Andy, 34

Works part-time, is finishing his degree, lives with his partner

Andy, 34

Works part-time, is finishing his degree, lives with his partner

His budget is limited, and looks for discounts and bundles relevant to him.Enjoys cable and streaming subs for entertainment. Shares subscriptions with friends to keep the cost down.

Wants to be in-the-know, he likes the latest tech.

Uses trials and offers, but does forget to cancel.

Research

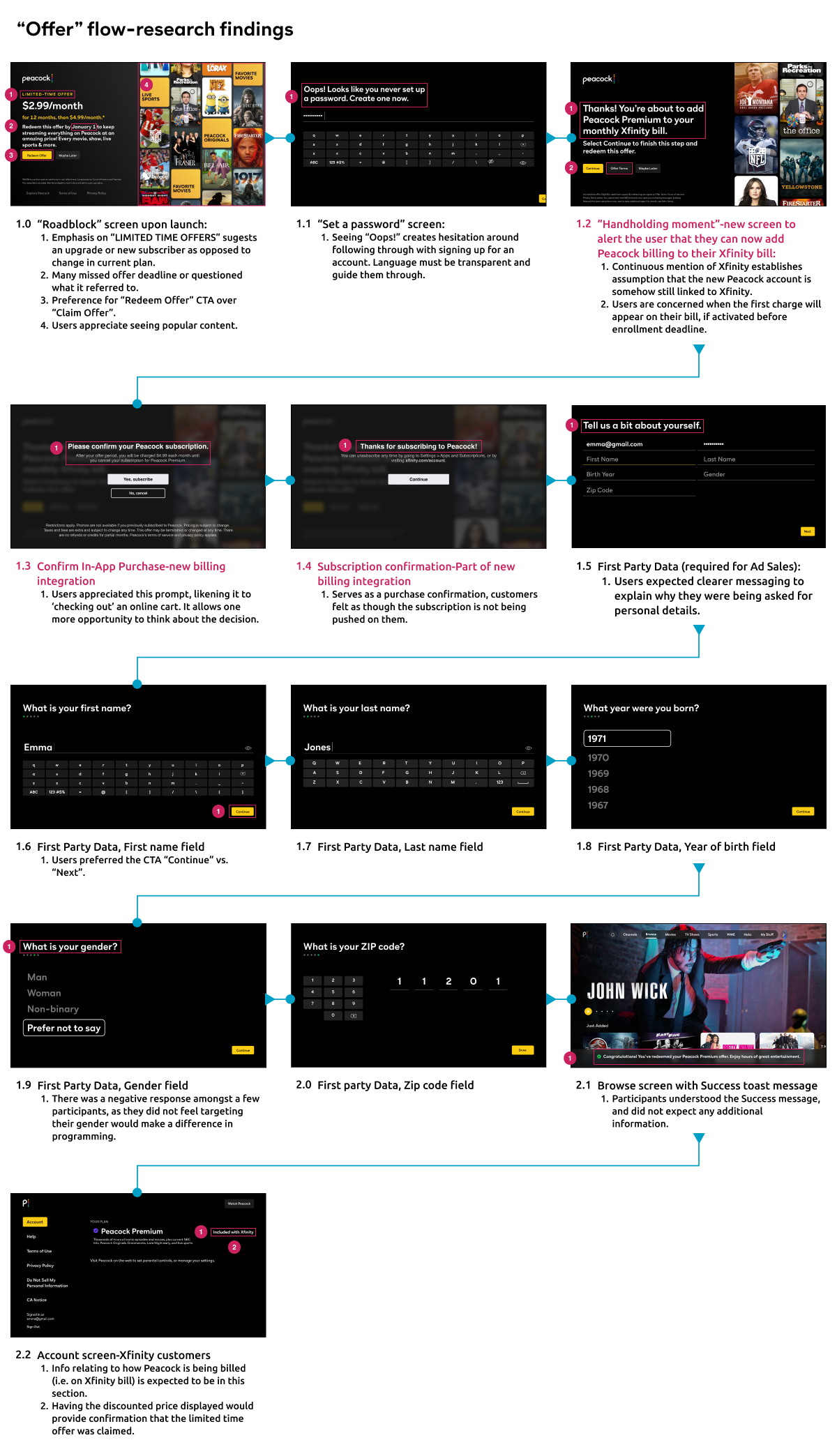

Testing the "offer" purchase flow for Xfinity bundled customers

Initial exploratory insights to help frame strategy and communication around Bundled execution, and understand attitudes around subscribers' current Bundled experience and receptivity of the Peacock signup process. We collaborated with boutique agency, Machine during the Research stage of this large initiative.

We aimed to identify drivers of appeal and resistance as well as message clarity among various stim executions. We tested offers and messaging flow of the stim – which helped guide future iterations.

We conducted 7 interviews among Bundled (Xfinity) tier Peacock subscribers.

Offer-related research findings

Customer journey

"Inform" messaging phase, May 1-June 25

In the scenario below, users are logged in to their Set Top Box. On the backend, we would check to see whether user is qualified (already linked) on Xfinity cable devices. The Toast message would be dismissable after launching the app on their TVs, to allow the user to continue browsing. This was not an aggressive campaing, more of an "information" moment. For the Toast conditions, we would wait for 15 days before showing the notification again.

The "Learn more” CTA would take them to a screen with messaging to alert the user that Premium would no longer be available.

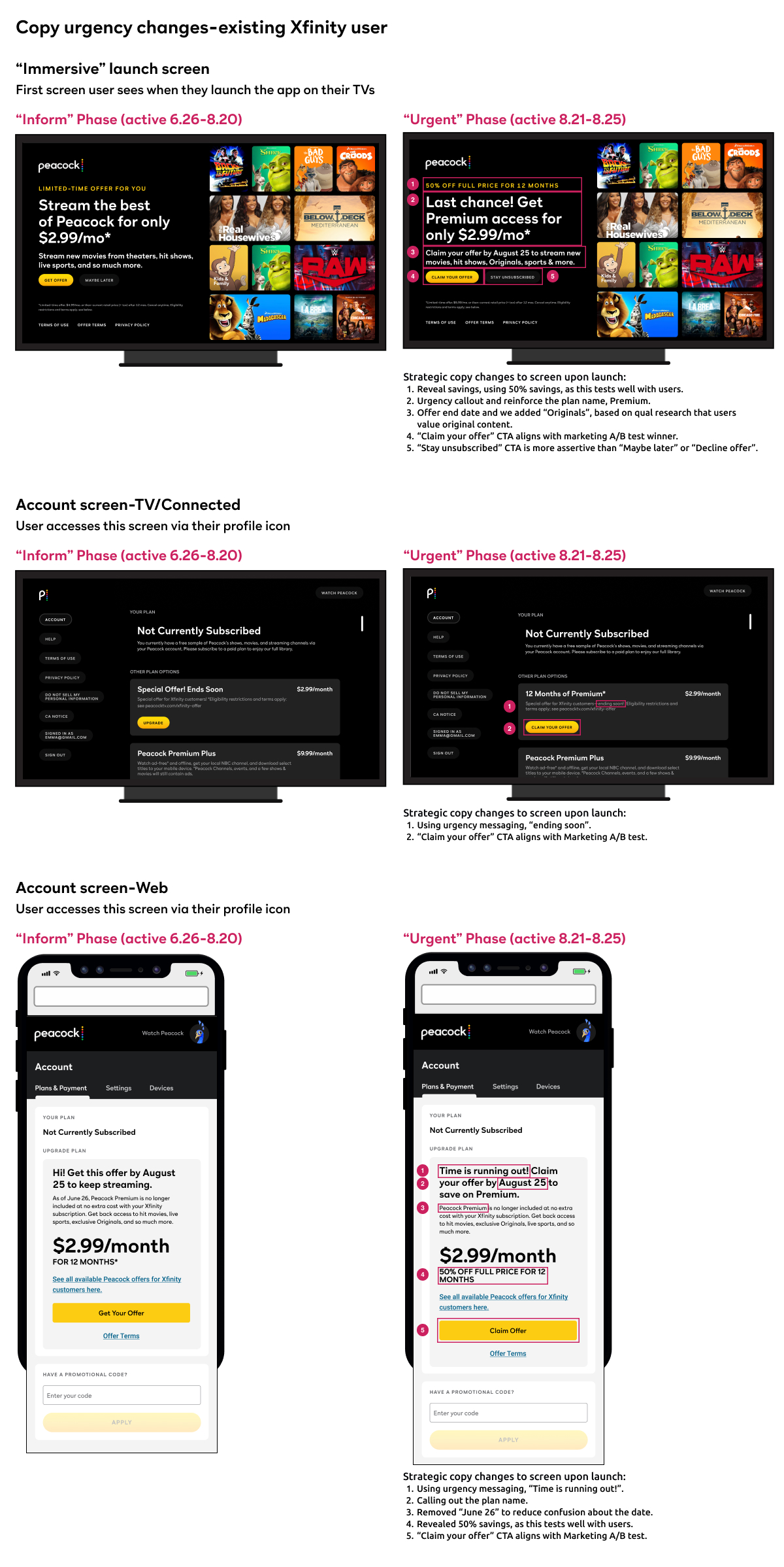

Offer urgency copy changes, August 18-25

We brainstormed how we could position the copy in an urgent fashion, collaborating with Marketing to discover their learnings when presenting offers to potential customers. Due to tight timelines for our Engineering teams, we were unable to set up an A/B test during the one month timeframe in order to test copy positioning.

There was an 8% increase in customers who rolled to pay during this timeframe.

Below is a comparison of the 3-week timeframe for the "Inform" phase on key screens, with copy changes during this "Offer urgency" week of the 18-25th.

Offer ended, August, 2023

Users who did not taken the lower price Offer will be considered "Unentitled Users", where they can still browse Peacock, but only access a small amount of free content.

The toast notification interval that appeared from May to June 15 would be hidden. Upon launch of the app, a "Roadblock" screen would show a message to the user that they will need to select a plan and purchase it through their TV IF the user is on an In-App Purchase TV (Xfinity cable box, COX cable, Roku, etc.). They can dismiss the Roadblock and still view our catalogue, but will only have access to some "Free" content.

After an additional round of Qual testing, we decided not to include the "handholding" moment/screen before the Method of Payment moment, as we noticed some fatigue when participants were going through the purchase journey.

The results

Bundled customers have rolled to pay, or are entitled to free content

What did I learn?: This was the largest initiative I had ever worked on, so I worked with our Project Manager to organize myself, updating the team with progress each day via Slack.